Insurance License Renewal Staying compliant as a licensed insurance agent requires more than just passing your initial licensing exam. One of the most important responsibilities is renewing your insurance license before it expires. Whether you’re a seasoned professional or just starting your career, understanding how the insurance license renewal process works can save you time, money, and stress.

In this comprehensive guide, we’ll walk you through everything you need to know about insurance license renewal, including when to renew, the steps involved, continuing education (CE) requirements, and what happens if your license expires.

What Is Insurance License Renewal?

The Purpose of Renewal

Insurance license renewal is a process required by all states to ensure that licensed insurance professionals remain up to date with current laws, ethical standards, and industry practices. This renewal typically occurs every one to two years, depending on your state and license type.

Who Needs to Renew?

Any individual or business entity holding an active insurance license — whether for life, health, property, casualty, or other lines — must renew it before the expiration date to continue selling or advising on insurance products legally.

How Often Should You Renew Your Insurance License?

Renewal Cycles by State

The renewal cycle varies by jurisdiction. In most states, insurance licenses must be renewed every two years. However, some states follow an annual schedule or base renewal on the agent’s birthday.

Where to Check Your Renewal Schedule

You can verify your license status and expiration date by visiting the National Insurance Producer Registry (NIPR) website or your state’s Department of Insurance.

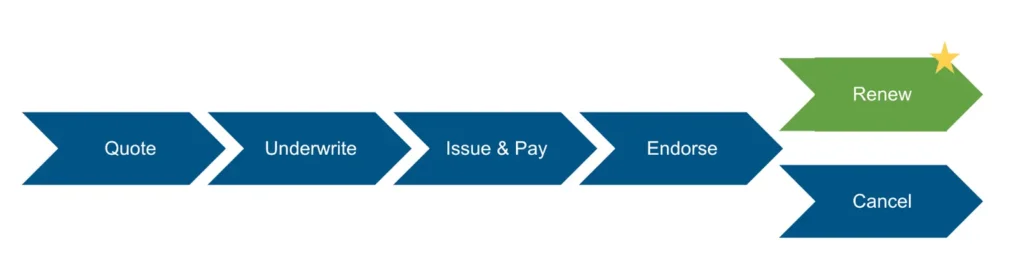

Step-by-Step Insurance License Renewal Process

Step 1: Complete Continuing Education Requirements

Most states require licensed agents to complete a certain number of Continuing Education (CE) hours before renewal. CE ensures that agents stay informed about current laws, ethics, and policy updates.

- Typical requirements: 12–24 CE hours every renewal cycle

- Ethics training: At least 3 hours dedicated to ethics

- Line-specific CE: Some lines like long-term care or annuities require specialized courses

Step 2: Gather Required Information

Before beginning the renewal process, make sure you have:

- Your license number

- Your NIPR or state login credentials

- Proof of completed CE (your CE provider usually reports this automatically)

- A credit or debit card for payment

Step 3: Submit the Renewal Application

You can renew your license through:

- State Insurance Department websites: For state-specific processing

Submit the online form, review your details, and pay the required fee.

Step 4: Pay the Renewal Fee

Fees vary by state and license type. On average:

- Individual license renewal: $25–$150

- Business entity renewal: $100–$500

Late renewal or reinstatement may carry extra charges.

Step 5: Receive Confirmation and Updated License

Once your application and CE are verified, your license status will be updated. Most states issue a digital license, while some offer optional paper copies.

Continuing Education (CE) for License Renewal

Why CE Is Important

Continuing education is not only a renewal requirement but also a valuable way to stay ahead in the ever-changing insurance landscape. It ensures ethical practice and current knowledge of regulations.

How to Find Approved CE Providers

CE courses must be approved by your state. You can find approved providers through:

- Your state Department of Insurance

- NIPR’s CE Lookup Tool

- Accredited online CE platforms

Tips for Completing CE on Time

- Don’t wait until the last minute

- Use online platforms for flexibility

- Take ethics courses early in your cycle

- Track your completed hours through the CE portal

What Happens If You Miss the Renewal Deadline?

Lapsed License

If you miss the renewal deadline:

- You may be unable to legally sell or advise on insurance

- You could face fines or penalties

- Your clients may be affected by your inability to represent them

Reinstatement Process

Reinstatement rules vary but may include:

- Paying late fees

- Completing additional CE hours

- Submitting a reinstatement application

- Waiting a certain period before reapplying

Some states require you to retake the licensing exam if your license remains expired for too long.

License Renewal for Multiple States

Resident vs. Non-Resident Licenses

If you hold licenses in multiple states:

- Renew your resident license first

- Non-resident licenses often renew automatically, but you must still check with each state

Multi-State CE Reciprocity

Many states recognize CE credits from your home state through reciprocity agreements. However, some require state-specific training, so check each state’s rules.

Common Mistakes to Avoid

Waiting Until the Last Minute

Delaying CE completion or renewal submission is the most common error. Start early to avoid surprises or system issues.

Not Updating Contact Information

Failure to update your address or email with the Department of Insurance can result in missed reminders or delays in receiving your license.

Assuming CE Is Automatically Reported

While many providers report your CE, it’s still your responsibility to ensure it’s recorded correctly with your state.

Using Unapproved CE Providers

Always choose courses approved by your state. Non-approved CE will not count toward your renewal.

How Technology Makes Renewal Easier

Online Renewal Portals

Websites like NIPR, Sircon, and individual state portals allow you to:

- Submit renewals online

- Track license status

- View CE progress

Mobile Apps and Alerts

Some CE platforms and state departments offer apps or text/email alerts to help you stay on track with deadlines.

Renewal Tips for Specific License Types

Life and Health Insurance Agents

- Watch for CE on long-term care, Medicare, and annuities

- Ethics training is usually required

Property and Casualty Insurance Agents

- Keep up with risk management, claims handling, and commercial coverage CE

- CE requirements vary by product line

Adjusters

- Many states require adjuster-specific CE

- Pay attention to catastrophe claims and state law updates

Benefits of Timely Insurance License Renewal

- Maintains legal compliance

- Avoids costly reinstatement fees

- Protects your reputation and client trust

- Prevents interruption in commission payments

- Ensures uninterrupted access to insurance carriers

Also Read : Comprehensive Guide To Marine Insurance: Coverage, Claims, And Best Practices

Conclusion

Renewing your insurance license is a crucial part of maintaining your career as a professional insurance agent. Although the process may seem routine, missing key deadlines or failing to complete continuing education can lead to serious consequences — including suspension of your license or legal penalties.

Understanding the renewal process, staying on top of CE requirements, and using tools like NIPR and CE tracking platforms can make the entire experience much smoother. By staying organized and proactive, you’ll ensure your license stays active and your career on track.

Frequently Asked Questions (FAQs)

When should I renew my insurance license?

Most states require renewal every 1 to 2 years. Always check your license expiration date through your state’s Department of Insurance or NIPR.

How much does it cost to renew an insurance license?

The cost varies by state and license type, but it typically ranges from $25 to $150 for individuals.

What happens if I don’t renew my license on time?

Your license may lapse, and you’ll be unable to legally conduct insurance business. You may also incur late fees or be required to reapply.

Do I need to retake the exam to renew my license?

No, unless your license has been expired for a long period. In that case, some states may require re-examination.

How many CE hours are required for renewal?

Requirements vary by state, but most require 12 to 24 hours, including at least 3 hours of ethics training.