Introduction

Securing the right financing is often a major step in growing or sustaining a business. Among the many options available, secured business loans stand out for offering substantial borrowing amounts at competitive rates. But how do they work, and who should consider applying for one? In this guide, we’ll explain everything you need to know about secured business loans — from how they operate to the key benefits, potential risks, and eligibility criteria.

Understanding Secured Business Loans

What Is a Secured Business Loan?

A secured business loan is a type of financing where the borrower pledges an asset — known as collateral — to the lender in exchange for a loan. If the borrower defaults on repayment, the lender has the legal right to seize and sell the collateral to recover the outstanding loan balance.

Common Collateral Types

- Real estate (commercial or residential property)

- Equipment or machinery

- Inventory or stock

- Business vehicles

- Accounts receivable

- Certificates of deposit (CDs) or savings accounts

How Secured Loans Differ From Unsecured Loans

Unlike unsecured loans, which rely solely on the borrower’s creditworthiness, secured loans are backed by tangible assets. This significantly reduces the lender’s risk, often leading to better interest rates and larger borrowing amounts.

How Secured Business Loans Work

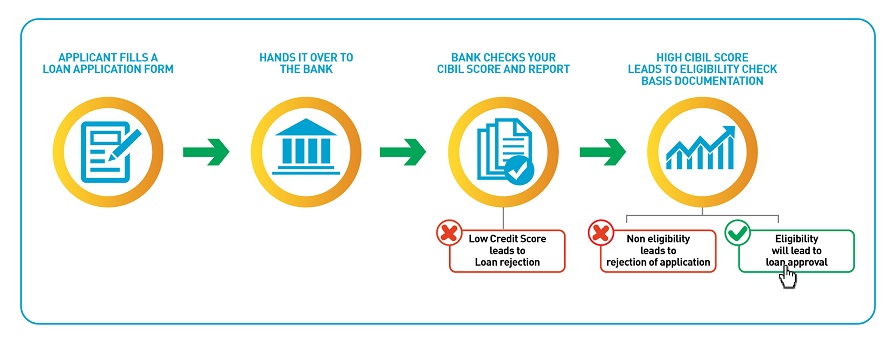

Loan Application Process

- Assessment of Financial Health: Lenders evaluate your business credit score, revenue, profitability, and overall financial health.

- Collateral Valuation: The pledged asset is assessed for its market value to determine the loan amount.

- Loan Terms and Agreement: Once approved, both parties agree on the loan amount, interest rate, repayment schedule, and collateral terms.

- Disbursement of Funds: Funds are usually disbursed in a lump sum.

- Repayment: Regular payments (monthly or quarterly) include both principal and interest until the loan is fully repaid.

Typical Loan Terms

- Loan Amounts: $10,000 to several million dollars

- Interest Rates: 3% to 15% annually, depending on creditworthiness and collateral value

- Repayment Periods: 1 to 25 years

- Approval Time: From a few days to several weeks, depending on asset valuation and documentation

Advantages of Secured Business Loans

Higher Borrowing Limits

Because the lender has a form of security, they are usually willing to offer larger amounts than unsecured loans.

Lower Interest Rates

Secured business loans generally come with more favorable interest rates, reducing the total cost of borrowing over time.

Flexible Terms

With adequate collateral, borrowers often have the flexibility to negotiate longer repayment terms or lower monthly payments.

Easier Approval

Businesses with less-than-perfect credit histories may still qualify if they can offer valuable collateral.

Disadvantages of Secured Business Loans

Risk of Losing Assets

If the business defaults, the lender has the right to seize and sell the pledged collateral.

Lengthy Approval Process

Valuing the collateral and processing the application can take longer than unsecured loans.

Strict Collateral Requirements

Some lenders may require high-value or very specific types of collateral, which could limit accessibility for certain businesses.

Who Should Apply for a Secured Business Loan?

Established Businesses

Companies with solid operations and valuable assets looking for large loan amounts or better interest rates should consider secured loans.

Businesses Needing Lower Rates

If minimizing borrowing costs is critical, securing a loan with an asset can dramatically reduce the interest rate.

Businesses With Lower Credit Scores

Companies that may not qualify for unsecured loans due to weaker credit profiles might still get approved if they have acceptable collateral.

Businesses Needing Long-Term Capital

If you’re planning to invest in property, machinery, or large-scale expansion, secured loans provide the longer repayment periods and higher amounts needed for such investments.

Factors to Consider Before Applying

Collateral Valuation

Ensure that your pledged asset is worth enough to cover the loan amount, and remember that undervaluation could limit the borrowing limit.

Loan-to-Value (LTV) Ratio

Most lenders offer loans up to a certain percentage of the collateral’s value — usually 70% to 90%.

Repayment Ability

Assess your business’s cash flow to ensure you can meet regular repayments, avoiding the risk of default and asset loss.

Legal and Tax Implications

Transferring or pledging business assets can have tax implications. It’s advisable to consult with a financial advisor.

Alternative Financing Options

Compare secured loans with other financing options like unsecured loans, business lines of credit, or SBA loans to determine the best fit.

Alternatives to Secured Business Loans

Unsecured Business Loans

Offer faster approval but with higher interest rates and lower borrowing limits.

SBA Loans

Government-backed loans offering competitive rates and long repayment terms with less collateral requirement.

Equipment Financing

Specifically used to purchase equipment, where the equipment itself acts as collateral.

Business Lines of Credit

Flexible financing where businesses can draw funds as needed up to a certain limit, with variable repayment terms.

How to Increase Your Chances of Approval

Prepare Strong Financial Documentation

Have up-to-date financial statements, tax returns, cash flow projections, and a business plan ready.

Offer High-Value Collateral

Assets like real estate or expensive equipment can improve your borrowing power and loan terms.

Maintain a Healthy Credit Profile

Even though collateral matters most, having a better credit score can still help secure lower interest rates.

Shop Around for Lenders

Not all lenders offer the same terms. Compare banks, online lenders, and credit unions to find the best offer.

Common Mistakes to Avoid

Overleveraging Assets

Borrowing too much against your assets could put your business at high risk if cash flow fluctuates.

Ignoring Fine Print

Always read the loan agreement carefully for terms related to default, early repayment penalties, and asset seizure policies.

Not Planning for Repayment

Ensure that your business’s projected cash flow can handle the loan repayment schedule before committing.

Also Read : Essential Business Loan Documentation For Fast Funding

Conclusion

Secured business loans can be a powerful financing tool, especially for businesses looking for substantial capital with manageable interest rates. By pledging assets like property or equipment, companies can access larger funds and better terms. However, with the potential rewards come risks, particularly the danger of losing valuable assets in case of default. Businesses must carefully assess their financial health, collateral value, and repayment capacity before committing to a secured loan. When used wisely, secured loans can fuel growth, expansion, and long-term success.

FAQs

What is a secured business loan?

A secured business loan is financing backed by collateral, such as property or equipment, which the lender can seize if the borrower defaults.

How is a secured loan different from an unsecured loan?

A secured loan requires collateral and typically offers lower interest rates, while an unsecured loan depends on the borrower’s creditworthiness and usually comes with higher rates.

What types of collateral can I use for a secured business loan?

Common collateral includes real estate, vehicles, inventory, machinery, and accounts receivable.

Are secured business loans easier to get?

Yes, secured loans often have easier approval criteria because the lender’s risk is reduced by the pledged collateral.

What happens if I default on a secured business loan?

The lender can seize and sell your pledged asset to recover their money.

How much can I borrow with a secured business loan?

Loan amounts vary but can range from $10,000 to several million dollars, depending on the collateral’s value and your business’s financial health.

Can startups get secured business loans?

Yes, startups with valuable collateral or strong financial backers may qualify for secured business loans.

How long does it take to get approved for a secured business loan?

Approval can take anywhere from a few days to several weeks, depending on the lender and the complexity of collateral valuation.

Is collateral always required for a business loan?

No, collateral is specific to secured loans. Unsecured loans do not require collateral but often have stricter credit requirements.

Where can I find secured business loan options?

Secured business loans are available through traditional banks, online lenders, credit unions, and specialized commercial finance companies.