Efficient working capital management is crucial for any business aiming to maintain liquidity, streamline operations, and drive profitability. Whether you’re managing a small startup or a multinational corporation, understanding the dynamics of working capital helps ensure your company runs smoothly and can meet short-term obligations.

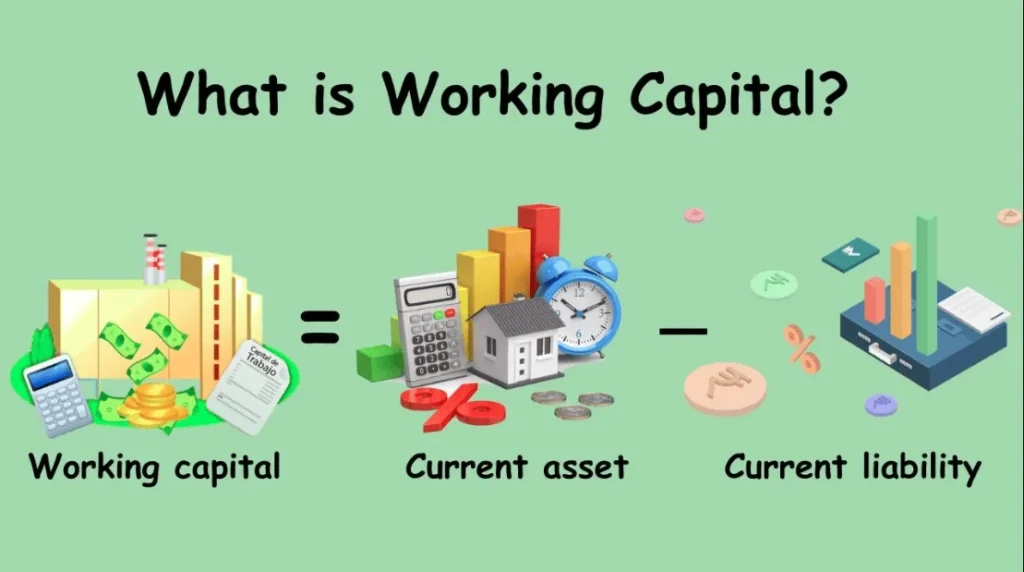

What is Working Capital?

Working capital refers to the difference between a company’s current assets and current liabilities. It represents the liquidity available to a business to cover day-to-day expenses.

Formula:

Working Capital = Current Assets – Current Liabilities

Importance of Working Capital Management

Effective working capital management ensures that a business has sufficient cash flow to meet its short-term debt obligations and operating expenses. It directly impacts:

- Operational efficiency

- Profitability

- Creditworthiness

- Business sustainability

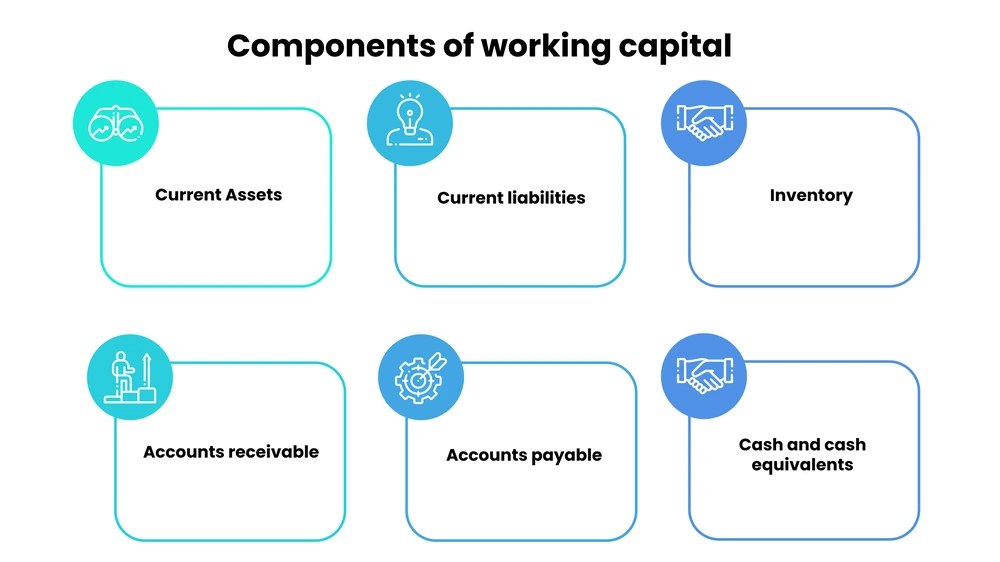

Key Components of Working Capital

1. Cash and Cash Equivalents

Cash is the most liquid asset and a key component of working capital. It is essential for meeting immediate financial obligations and seizing new business opportunities.

2. Accounts Receivable

Accounts receivable is the money owed to the company by its customers. Managing receivables efficiently ensures timely collection and reduces bad debts.

3. Inventory

Inventory includes raw materials, work-in-progress, and finished goods. Effective inventory management minimizes holding costs and prevents stockouts or overstocking.

4. Accounts Payable

Accounts payable is the money a company owes to suppliers and creditors. Timely payments avoid late fees and maintain healthy business relationships.

Objectives of Working Capital Management

Ensuring Liquidity

A primary objective is to ensure that the business has enough liquidity to fund daily operations.

Optimizing Operational Efficiency

Efficient working capital management helps in maintaining smooth business operations without unnecessary interruptions due to cash shortages.

Maximizing Profitability

By reducing idle resources and improving turnover ratios, companies can enhance profitability.

Reducing Financial Risk

Proper working capital planning helps reduce reliance on short-term borrowing, lowering financial risk.

Best Practices in Working Capital Management

1. Monitor Cash Flow Regularly

Tracking cash inflow and outflow allows businesses to anticipate shortages and avoid overdraft fees.

2. Improve Receivables Collection

- Set clear payment terms

- Offer discounts for early payments

- Use invoicing software for automation

3. Optimize Inventory Levels

- Implement Just-In-Time (JIT) inventory

- Use demand forecasting tools

- Conduct regular inventory audits

4. Extend Payables Strategically

- Negotiate favorable payment terms

- Avoid late payments

- Take advantage of vendor discounts when available

5. Use Financial Ratios

Current Ratio

Measures liquidity by comparing current assets to current liabilities.

Formula: Current Ratio = Current Assets / Current Liabilities

Quick Ratio

More conservative than the current ratio, it excludes inventory.

Formula: Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Working Capital Turnover Ratio

Shows how efficiently working capital is being used to generate sales.

Formula: Net Sales / Working Capital

Working Capital Financing Options

Trade Credit

A cost-effective way to finance working capital by obtaining goods/services now and paying later.

Bank Overdrafts

Short-term loans that offer flexibility for businesses facing temporary cash shortfalls.

Lines of Credit

Pre-approved credit limits that businesses can draw from as needed.

Invoice Financing

Businesses can borrow money against their outstanding invoices to improve cash flow.

Technology in Working Capital Management

Automation Tools

Using software for invoicing, accounting, and inventory management reduces human error and speeds up processes.

AI and Predictive Analytics

AI tools can forecast demand and cash flow more accurately, helping businesses make better decisions.

Cloud-Based Systems

Real-time access to financial data enables quicker responses to working capital needs.

Sector-Specific Approaches

Manufacturing

High inventory turnover and supply chain efficiency are vital for managing working capital in manufacturing.

Retail

Retailers must focus on inventory and customer payment cycles to maintain liquidity.

Services

Service businesses should manage receivables tightly as they often deal with long billing cycles.

Challenges in Working Capital Management

Seasonality

Fluctuations in demand can cause working capital issues if not properly planned.

Economic Downturns

Recessions can reduce cash inflows and increase default risks.

Poor Credit Management

Loose credit policies may lead to bad debts and impaired cash flow.

Benefits of Efficient Working Capital Management

- Improved liquidity

- Stronger financial health

- Better vendor and customer relationships

- Increased operational flexibility

- Higher investor confidence

Also Read : Why A Gold Loan Is The Best Option For Financial Emergencies

Conclusion

Working capital management is more than just balancing cash in and out. It’s a strategic process that directly impacts a company’s profitability and operational efficiency. By implementing the best practices outlined above and utilizing modern technology, businesses can gain greater control over their finances and position themselves for long-term success.

FAQs

What is the difference between working capital and cash flow?

Working capital is a snapshot of a company’s current assets and liabilities, while cash flow refers to the movement of money in and out of the business over a period of time.

Can a company have too much working capital?

Yes, excessive working capital can indicate inefficient use of resources, such as too much inventory or idle cash.

How often should a business review its working capital?

Businesses should review their working capital at least monthly or more frequently during volatile periods.

Is working capital the same for all industries?

No, different industries have different working capital needs based on operational cycles, credit terms, and seasonality.

What tools can help manage working capital?

Invoicing software, inventory management systems, cash flow forecasting tools, and ERP systems can significantly improve working capital management.